Data and Reports

Investments, workforce, distribution, turnover: every aspect of Rimadesio reality is represented through data and charts that allow to grasp in detail the constant and progressive evolution.

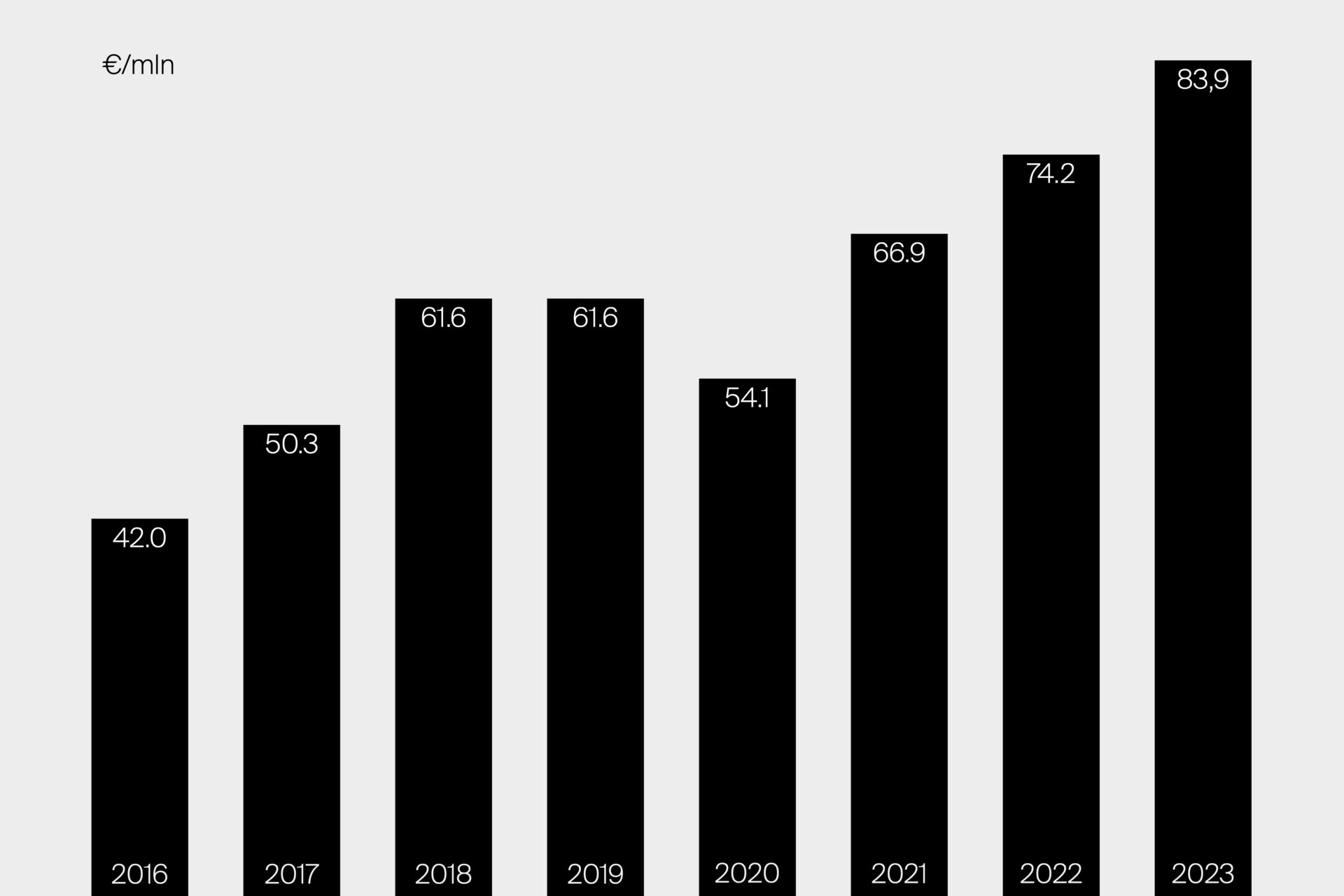

Turnover

Rimadesio continues its unstoppable growth, with record numbers set on a monthly, half-yearly and annual basis. This reflects the solidity robustness of the brand and underlines the key role of the distribution network made up of 80 monobrand stores and a network of selected dealers worldwide.

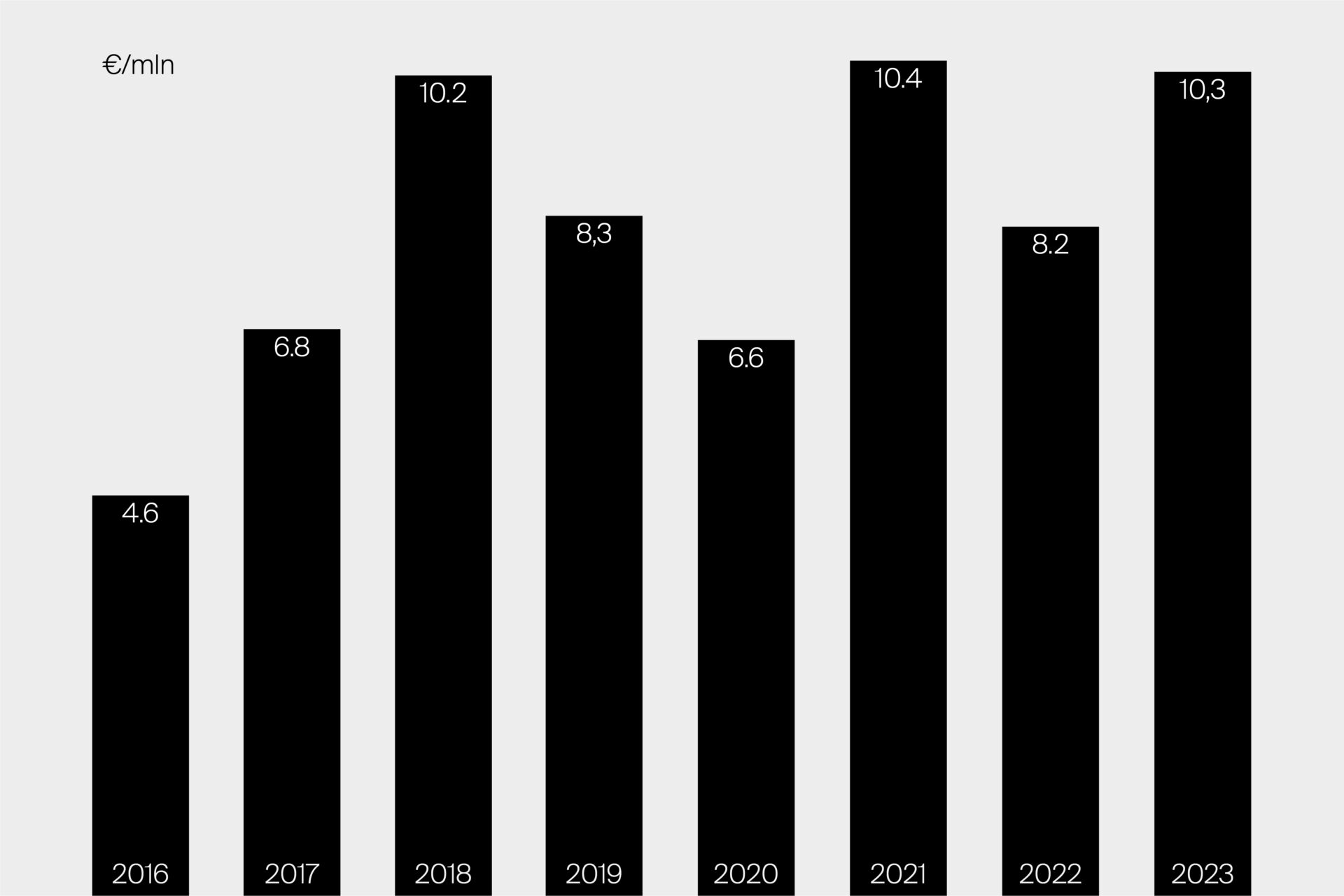

Ebit

EBIT – Earnings Before Interest and Taxes – is the result of the company’s operating performance from which the costs for depreciation and provisions are deducted. It indicates the income created by the company during its normal activity, also considering the impact of investments in capital goods or assets.

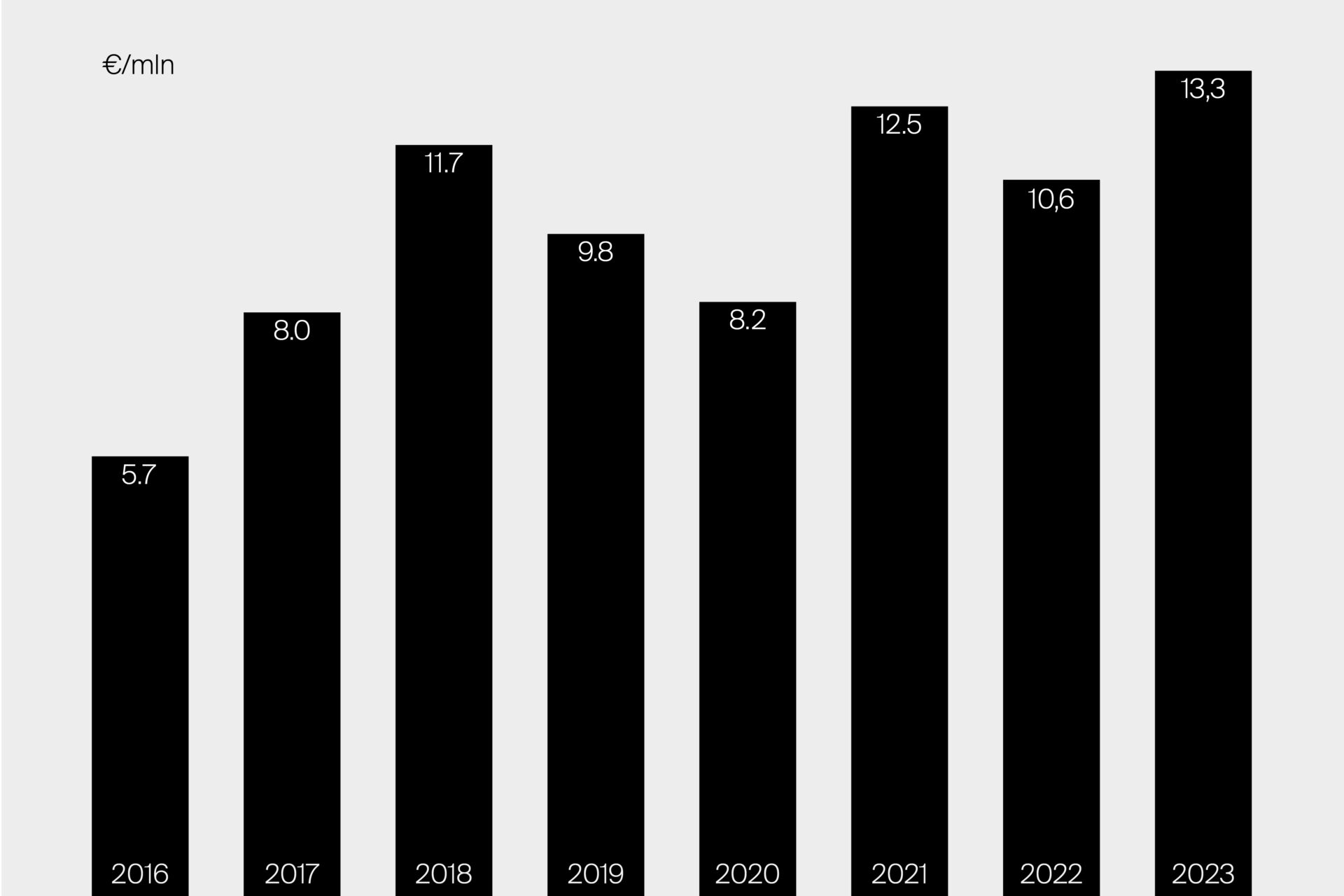

Ebitda

EBITDA – Earnings Before Interest, Taxes, Depreciation and Amortization – is the metric used of the company’s operating performance and indicates, whether it is able to generate income in its normal activity, without considering investments and extraordinary, financial and tax.